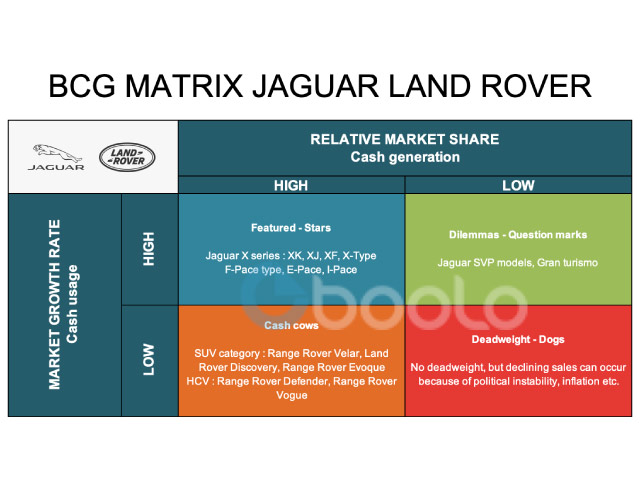

Since 1960, Boston Consulting Group has implemented a formula for the effective management of its various departments. This is the BCG matrix. Faced with its dazzling efficiency, the BCG matrix will very soon be appreciated by several firms and used as a determining tool for the management and marketing of products. In this article, we will see what it consists of, and then we will perform an analysis of Jaguar Land Rover products according to the BCG matrix.

The BCG matrix in brief

The BCG matrix is an analytical model that allows you to compare different areas of activity in order to make strategic and above all, rational choices. It provides information on the status of the activity portfolio and gives guidelines on funding requirements.

The BCG matrix is represented by two variables. On the y-axis, the growth rate assesses the dynamics of the activity segment analysed. It is on an increasing scale from 0 to 20%, 10% being the median value. On the x-axis, the relative market share reveals the company's position vis-à-vis competitors. It is graduated from 0 to 10 from right to left, 1 being the median value. The intersection of the two median values gives four quadrants that characterise the area of strategic activities and define the key actions to be implemented. These are, according to the life cycle, star products, dilemmas, dead weights, and cash cows.

Jaguar Land Rover

Jaguar Land Rover is a multinational firm specialising in the production, assembly, and marketing of luxury cars. It sells both B to B and B to C. Its clientele is thus made up of executives, businessmen, professionals, etc. The strategic diagnosis of JLR's portfolio of activities, according to the BCG matrix, took into account this diversity of customers, their lifestyle, their interests, their purchasing behaviour, and their psychography.

Jaguar Land Rover's BCG matrix

Cash cow

These are the products whose profitability is much higher than the investment devoted to them. Their financial needs for both production and sales are, therefore, low. The profits of cash cow products are called upon to be reinvested intelligently in order to continue to milk resources.

The large SUV category, Sport Utility Vehicle, is classified in the cash cow quadrant of the JRL company. These vehicles combine comfort and resistance. According to the consumers surveyed1, it is the sporty look and high performance that ensure the good positioning of these cars. These are, more generally, 4x4s and Crossovers, and more specifically, the Range Rover Velar and the Land Rover Discovery. Likewise there are cars with HCV and light commercial vehicles, such as the Range Rover Defender and the Range Rover Vogue.

Jaguar Land Rover invests heavily in the research and development of cash cow products. The goal is to prevent these products from falling into the category of dilemmas.

Featured

Here, the growth rate and market share are relatively high. These products generate strong financial needs, but their profitability is just as strong. Their future growth is more promising; this is the reason why the company does not hesitate to invest funds in it. It is partly thanks to the star products that the company could be self-financing.

Jaguar X series cars are star products. These are the Jaguars XK, XJ, XF, X-Type, etc. According to the web informant3, Le Guide de l'Auto, F-Pace type cars account for 60% of sales in Canada. The E-Pace collection and I-Pace have also become stars in the market. The I-Pace features electric motors rivalled by the Mercedes EQ, the Q6 audit, and Tesla Model X4.

These star products justify the notoriety of the company. According to consumers, these are the best automobiles made in the world. JLR's strategy is focused on market penetration and development. The objective is to be able to maintain the stars in their position for as long as possible.

Dilemma

The sector has high growth in the market, but the profitability of the product is low for the company. If the latter wishes to improve its competitive position, it will have to invest heavily in design, production, and even sales! Very clearly, the dilemma product is making a loss.

Special vehicles and vehicles designed for business are found in this category. This is partly justified by their novelty on the market. We basically find the Gran Turismo, jaguar SVP models. The Alfa Romeo Giulia II and Audi RD4 models compete with XE SV Project 8, a special vehicle from the JLR brand.

Jaguar Land Rover, essentially, emphasises warranty, after-sales service, and the possibility of customising colours. The goal is to gradually convert these products into the cash cow category.

Dead weights

Dead weights have low development potential. Their profitability is low, as is their financial need. The marketing strategy recommends not investing funds in it.

Jaguar Land Rover, thanks to its state-of-the-art technology and its strengths in research and development, does not have deadweight products on its market. However, sales representatives in some countries may experience declining sales in markets. This can be explained by political instability, inflation, etc.