Founded in 1824, it is one of the oldest companies in the world, specialising in the chocolate and confectionery sector. The group has three kinds of products: chocolates, Gummies, and candies. It should also be noted that the company is present in more than 60 countries and has 35,000 different suppliers, direct or indirect, as well as 190,000 retailers. In 2021, its turnover was 28.2 billion euros. Most of the group's brands were sold in 2017 and are now under the Carambar & Co name.

Matrix Explanations

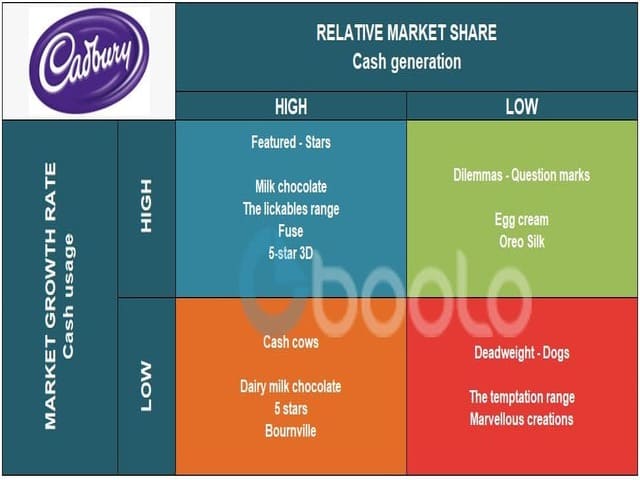

The two axes that frame the BCG matrix are relative market share horizontally and market growth rate vertically.

The first criterion analysed is the products considered as stars, that is to say, which are characterised by a strong market penetration as well as by an equally strong growth rate. In the case of Cadbury, several products fall into this category. These are the "milk chocolate" range, the "lickables", the "fuse" and the "5-stars 3D".

These references have a substantial market share, more than 18%, which gives them a dominant position within the company. They enable the group to generate greater turnover, thus ensuring the future of the brand. Despite the intensity of the investments put forward, whether, at the financial, organisational, or communication level, these products remain necessary for the group and are among the most popular with consumers at any given time. Granted, they aren't always the biggest earners for the group, but according to the BCG matrix, they are mostly set to be the group's cash cows in future years once the market is saturated.

The cash cows at Cadbury are the dairy milk chocolate, 5-star, and Bournville confectionery ranges. From an economic point of view, cash cows are the company's most profitable products. Therefore, they require little investment, so the company has every interest in keeping them in its catalogue. Cadbury's cash cow products have a very childish design, which is a change from what consumers usually see on the shelves. The company's communication policy and marketing strategy focus on customer relations, and on more elaborate and colourful packaging than what other competitors on the market can offer.

These cash cows hold a competitive position that is very important, despite the fact that they are located in a market that is almost saturated. Indeed, today, players in the world of confectionery and chocolate must constantly innovate to interest customers, with references multiplying on store shelves. Chocolate, in all its forms, is one of the best-selling products in the world. For Cadbury, cash cows represent immediate benefits, and these are used to promote other products that are struggling to start and find their place on the market or even develop innovations.

The star products, as well as the cash cows, are the most important for the group, and Cadbury willingly associates them with various partnerships. Recently, its digital campaign was associated with certain English football clubs, which allowed it to increase its notoriety even more and gain additional market share. Social trends and networks enable the group to strengthen sales of star products and cash cows. Highlighting football players and using them as influencers at the same time strengthens the image and dynamism of the company. It should also be noted that this promotion allows consumers to benefit from branded products as well as tickets to the games of their choice.

Products seen as dilemmas for the group are egg custard and the "Silk Oreo" range. For the company, dilemmas have low market penetration despite strong market growth. It is difficult for these product lines to counter competition that has become fierce in the space of a few years. In the case of Cadbury, the products in this range have gradually diversified due to increased rivalry in the market. These two products fail to differentiate themselves from the competition, and the company must try to find solutions to highlight them so that they do not end up as dead weight. To date, their future is uncertain, and thanks to additional analyses, the group will be better able to analyse the advantages and disadvantages of keeping them in the company. The dilemma products do not bring in enough money, yet on the other hand, they sometimes cost the group dearly, hence the need to modify the marketing strategy in the short term.

Deadweights are products defined by low market penetration in a market that is also defined as non-existent or at least declining.

The profitability of the products is zero or almost zero, and the company then has to ask if it is worth retaining the product or whether they discard them. Additional studies would have to be carried out in order to be able to analyse whether or not these products still have their place in the company. In the case of Cadbury, the deadweights are the "Temptations" and "Marvelous creation" ranges.

Today, the resources allocated to certain products must be limited in order to avoid penalising the company as a whole and to be able to generate greater expenditure in areas that are needed today, especially in view of the current competition, such as research and development.

The Cadbury group is very successful in Great Britain, as well as in other countries. Today, several of its brands have nevertheless been acquired by Orangina, a way for the group to focus on the product lines that work best. We were thus able to see, thanks to this BCG matrix, the products that the company should keep and those which, on the contrary, could quickly represent a threat to the company at the financial level. In addition, Cadbury's partnership with major English football clubs allows it to assert its position as a leader in the segment and to redefine a strategy more in line with the needs and expectations of consumers at any given time. The objective is twofold: on the one hand, to promote the group's products by making people discover new tastes, new packaging, or even new promotions, but also to offer gifts that may interest more consumers, a means of expanding its clientele. With this in mind, tickets to see certain matches have been won by consumers, in the context of competitions or other games.

Finally, the BCG matrix makes it possible to highlight the star products, which are the future cash cows. Depending on market trends, dilemmas can either become dead weights or star products and, in turn, become cash cows. The BCG matrix is cyclical, with products experiencing each phase at some point in their existence. Some deadweights are old dilemma products, old star products, or maybe innovations that failed to make their way to notoriety.

Sources: Verif, Boursieur, IIDE