I. General Motors in a nutshell

Long a leader in the field of automobile construction, General Motors has been adrift for several years. The company, which was founded in 1908 in the United States, continued to evolve until the end of the 1990s. At that stage, it owned up to 15 different car brands. But in the early 2000s, the company had to deal with excessive debts, and the 2008 crisis only pushed it even further into its difficulties. With its nationalisation in 2009 and subsequent re-listing on the stock exchange, the company was able to get back on a good footing without going back to what it had been. While in 1973, the company was the largest employer in the United States with more than 600,000 employees, in 2014, the company had three times fewer, a sign that the golden age was over.The company currently still has a large number of activities. Its main activity, which represents almost 90% of its turnover, concerns the construction and sale of motor vehicles that it carries out for several brands: Chevrolet, Buick, Cadillac, GMC, Holden, and Wuling. This main activity is supplemented by an insurance activity in the United States.

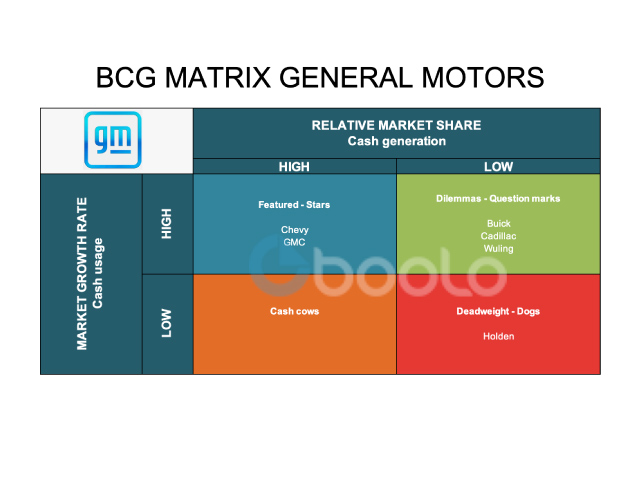

For each of its activities and its brands, the company markets different products and adopts a different strategy. The company has gone through difficulties, and the use of a BCG matrix can be a good tool to guide it in its strategic choices and its investments according to its position in the market.

II. General Motors and the competition

The total number of vehicles sold in 2020 was just over 77 million units. During this same year, General Motors was able to sell 6.8 million vehicles, thus posting a market share of 8.83%. If we take all the market shares of the main competitors Volkswagen, Alliance Renault Nissan, Toyota, Stellantis, Hyundai, Kia, Honda, Ford, Daimler, or Suzuki, we note average market shares of 7,69%. General Motors is positioned rather well, with relative market shares in fourth place behind Volkswagen, Alliance, Renault, Nissan, and Toyota. For several years, the automotive market has continued to grow. However, the coronavirus crisis has largely reduced car sales in the sector and even wiped out the growth of previous years. The growth of the automotive sector for the year 2021 is estimated at 11%, greatly exceeding the growth of previous years. Depending on the products sold by the company, we can, therefore, say that General Motors is in the star or cash cow categories.III. General Motors brands

It is relevant to take a closer look at the different brands and products sold by General Motors to deepen our BCG analysis.Stars

The brands that are the most lucrative for the company are Chevrolet and GMC. If we look only at the American market, which is the most important for General Motors, we can see that Chevrolet represented almost 68% of General Motors' American sales while GMC represented 20%. Of the nearly 15 million vehicles sold in the United States, Chevrolet's market share is, therefore 11.53% in a market that should show 13% growth in 2021. The Chevrolet brand represents a real Star in 2021, and the company has every interest in taking advantage of this position before the brand becomes a cash cow again, as has been the case in previous years. When this is the case again, the company will have to make strategic choices such as reducing its investments in Chevrolet or even reinvesting Chevrolet's cash in other more promising brands that represent cash cows or dilemmas.

Dilemmas

The other brands owned by General Motors that represent lower market shares in a market that would be growing strongly in 2021 present real dilemmas. But this situation will not last for years to come, and soon its marks will return to dead weight states. The company, therefore, has several strategic options. It can take advantage of the boom of the coming year to invest massively in brands that are promising, especially in marketing and research and development, to develop these brands and make them known to the general public in order to stand out from the competition. It may also decide to abandon the activity of certain brands in anticipation of a decline in growth in the sector in order to focus on other existing brands. Wuling can be a good business opportunity. The latter seeks to compete with Dacia and Toyota in China by offering accessible electric cars. This strategy can pay off for General Motors in a market with strong growth where the middle class is increasingly emerging. Wuling, which represents a real dilemma for General Motors, will therefore have to focus all the attention of the group.

IV. Conclusion

Of course, this analysis of General Motors is global, and it would be interesting to look at the case of each brand of the group, and the products sold in more detail. It can be noted that the year 2021 should represent good opportunities for the company, so it should take advantage.

Deadweight

However, in view of the relatively weak growth in normal times, one can wonder if the company should not reinvent itself, especially with regard to the brands which have very low market shares and which represent real dead weight for General. Motors. This was the case, for example, with the Australian brand Holden, which was suspended, and General Motors decided to stop producing in 2021. The company must therefore reinvent itself if it wants to boost its market share in the years to come.